AVOID THESE5 MISTAKES

WHEN YOU SET UP

A TAX SAVING STRUCTURE!

THE JURISDICTION WHICH YOU CHOOSE TO INCORPORATE YOUR COMPANY HAS TO BE COMPLIANT WITH THE COUNTRY OF YOUR RESICENCE!

If this is not the case the tax saving structure is classed as Tax Fraud and you will be fined. In the worst case it is classed as a Criminal Act.

Learn moreTAKE NOTE OF ALL TYPES OF TAX!

For example, if you forget the withholding tax, there will be a tax that has not been taken into account which will significantly reduce your income at the end of the year.

Learn moreDo not trust the statements of 0% taxes from providers on the Internet.

Just because, for example, a company in Hong Kong does not have to pay taxes does not mean that you as a shareholder do not have to pay taxes either.

Learn moreSales tax: In any case, observe the applicable sales tax guidelines.

In particular, if your services are aimed at consumers, the sales tax requirements must be observed. If you fail to do this, you risk high additional payments and make yourself liable to prosecution.

Learn moreDo you get accounts with payment providers with the company location you have chosen without any problems?

Often these points are not considered and suddenly you do not receive, for example, an urgently needed Paypal account and no bank account.

Learn moreTax optimizationis the key to create wealth and the foundation of every successful entrepreneur

Be aware when you incorporate an offshore company:

Look for a tax-honest structure that actually brings legal tax savings and does not result in a criminal offense.

Learn moreTrust professionals who have been in this industryfor years

The internet is full ofrightandwronginformation. It is difficult for an entrepreneur to distinguish between true and false. We are happy to help!

If you wantto reduceyour tax payments

and are a business owner there are

plenty of ways to do so

Our firm is specialized in creating and setting up tax saving structures.

What can I gain?

An example of how much tax

you can save

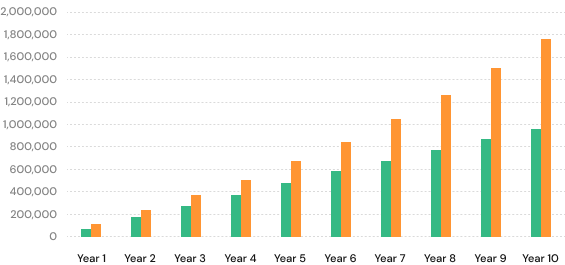

Imagine you would significantly reduce your tax burden and thus achieve a much faster wealth accumulation, so that you can live solely on dividends. The table below shows the difference between a permanent tax burden on assets compared to a holding model with a one-time burden at the time of distribution.

Wealth accumulation with and without tax comparison

Calculate

the tax you save

Annual profit:

Amount you saved after 10 years:

book-a-call

Book a free call on the Calendly:

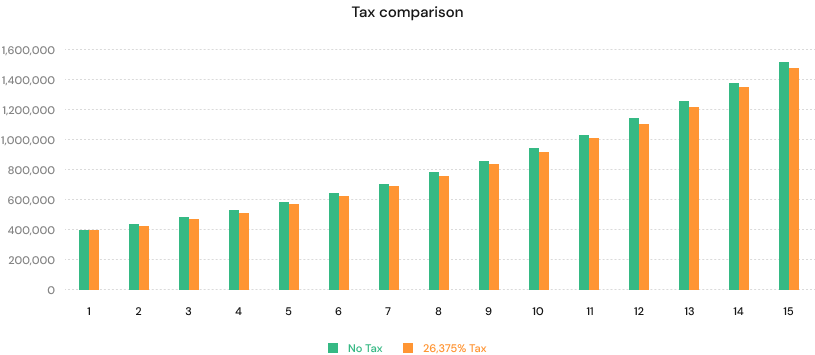

Numerical example

A small fortune i.H.v. 400k EUR can develop into assets of

3 million euros in 15 years,

with the right tax

structure. Without tax optimization,

the size of the assets would only be around EUR 2 million

Before

-

Tax rate of 52%

-

Cashflow problems when tax payments are due

-

Lack of investment opportunities

-

No spreading of risks

-

No asset protection in case of law-suit or divorce

After

-

Tax rate of 21% combined of worldwide income

-

No cashflow problems at any point

-

Asset protection

-

Reduced Inheritance tax

-

Low annual maintenance fees

-

Solid and stabile banking solutions

-

Perfect structure for any kind of investments

Network

est Asset Managers in Switzerland, USA and other countries

Bank with the best banks in Switzerland and join of the top 3 asset management companies of the country with a annual growth for your capital of up to 15%.

Exclusive investment opportunities

Exclusive property investment opportunity for investors in countries with high annual growth.

Expat solutions

Residency in Monaco, Malta, Portugal, Greece, Bulgaria, Spain, Germany, Austria, France

partners

Free consultation

Even though the demand for strategic tax planning is higher than ever before we still offer a 15 minutes free consultation for every interested business owner.

Book your free appointment now:

Worth 500 USD

What advantages do I get from your advice?

Primarily tax optimization with notable savings

Personal contact: Individual contact persons with extensive expertise (at least 10 years of experience)

Competent and binding information

Clear statements and help with all necessary steps, e.g., founding a holding company, etc.

No cost risk, since the added value for you is already determined in the analysis discussion (reference value)

Independent advice: instead of ready-made solutions, we look at all possible options and advise in all directions.

Network: We have an international network of experts for a wide variety of projects: structures in all countries, licenses, trusts, foundations, holding models, foreign companies, cooperatives, associations, real estate and much more.

frequently asked questions

I have already an account why should I seek any additional advice?

To gain relevant savings in taxes you need a minimum of 30.000 USD profit a year. If you plan is to move to another country or you plan to stay wherever you are now makes no difference. But to qualify you need to have an own business or you will start an own business shortly.

Do I qualify for tax optimization?

To gain relevant savings in taxes you need a minimum of 30.000 USD profit a year. If you plan is to move to another country or you plan to stay wherever you are now makes no difference. But to qualify you need to have an own business or you will start an own business shortly.

What are the solutions to save taxes?

To gain relevant savings in taxes you need a minimum of 30.000 USD profit a year. If you plan is to move to another country or you plan to stay wherever you are now makes no difference. But to qualify you need to have an own business or you will start an own business shortly.

Does it make sense to form a company abroad?

To gain relevant savings in taxes you need a minimum of 30.000 USD profit a year. If you plan is to move to another country or you plan to stay wherever you are now makes no difference. But to qualify you need to have an own business or you will start an own business shortly.

Are these structures legal?

To gain relevant savings in taxes you need a minimum of 30.000 USD profit a year. If you plan is to move to another country or you plan to stay wherever you are now makes no difference. But to qualify you need to have an own business or you will start an own business shortly.

What does a consultation cost and what do you guarantee?

To gain relevant savings in taxes you need a minimum of 30.000 USD profit a year. If you plan is to move to another country or you plan to stay wherever you are now makes no difference. But to qualify you need to have an own business or you will start an own business shortly.

Still have questions? Contact us:

About us

W-V Law Firm LLP is based in the heart on London and has more than 2000 clients from all over the world. With offices in Netherlands, Ireland, Malta, Singapore, Bucharest and London we have a team spread around the globe which works nonstop to fulfill our clients need.

We are specialized in high net worth individual clients. Our services are consulting, structure implementation, tax returns and banking and PSP solutions.

We have a global partner network

of 200 law and accountancy firms

in 161 countries.

Now it´s time to get in touch with us

Say no to high taxes and yes to more financial freedom!

Our team

regulations